In recent weeks, you may have heard that economic growth in China, the second-largest economy in the world, has slowed down to its lowest point in nearly three decades. The news itself is true, but depending on your source, you may find that some of the statistics and numbers telling the story differ.

The reason for the confusion is the statistics that are being released by Chinese government officials do not always agree with other sources. China’s National Bureau of Statistics, which reports much of the country’s data, is often considered to be focused predominately on helping the government look good rather than giving an accurate reflection of events.

In this blog post, our team of analysts report to you on the latest developments in the Chinese economy and how it will impact the manufacturing sector, especially the metal production industry.

The Situation in China

Just recently, the International Monetary Fund (IMF) announced that it had lowered its 2019 annual average global growth projection for China from 3.7% to 3.5% in the wake of an economic slowdown. Let’s look at some of the reasons why they lowered their expectations:

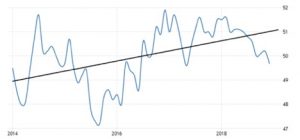

1. The Chinese Caixin Manufacturing Index is trending downward:

Source: https://tradingeconomics.com/china/manufacturing-pmi

2. Shanghai Composite Stock Market Index is showing ongoing decline in stock prices in 2018.

Source: https://tradingeconomics.com/china/stock-market

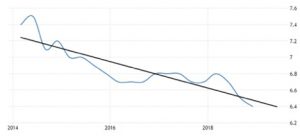

3. Chinese Annual GDP Growth is also declining

Source: https://tradingeconomics.com/china/gdp-growth-annual

The Main Causes of Economic Slowdown in China

One of the main causes of China’s economic slowdown is a decision made over 5 decades ago by the government at the time. In the past, China benefitted from a growing workforce, which advanced their GDP both by adding workers and because the young workforce was more productive and vibrant than its aging counterpart. In 2012, the working-age population started to shrink as a result of the One Child Policy, which was enacted in 1979. The number of babies born in China dropped to the lowest level in almost 60 years in 2018, despite the state’s efforts to undo the damage of the policy by encouraging the birth of more children. Indeed, the looming demographic crisis could be the Achilles heel of China’s stunning prior economic performance.

An increase in employee wages poses another barrier to economic growth in China. Chinese wages are now either on par or above those of most other emerging market economies. This alone makes China a less attractive destination for outsourcing among multinational corporations. The reason for this is because the Chinese government is trying to move away from a manufacturing and export-driven economy to a service and domestic-driven one.

The trade dispute with the United States put additional pressure on the Chinese economy and made the situation more dire. The government attempted to downplay the impact of Trump’s tariffs on approximately $200bn of Chinese imports into the U.S. But the evidence collected by our industry analysts suggest that the dispute is detrimental to China’s economic growth. With Trump threatening to impose tariffs on almost $300bn of extra imports sometime this year, including a 25% charge on imported cars, the situation could prove to be catastrophic for China and consumers.

The drop in manufacturing activity is the fourth and final cause, as identified by economic analysts. Several multinational companies have experienced some loss due to China’s slowdown, including Apple. The company Caterpillar shares took a hit too, after the company reported its sales dropped 4%, largely due to slowdown in China. Stricter regulations and wintertime shutdowns to combat pollution all contributed to a decrease in manufacturing activity over the past three years. Moreover, repeated stimulus packages are becoming less and less impactful, which shows that China simply cannot continue to grow at its prior rate.

Why Does China’s Economic Slowdown Matter?

It is clear that an economic slowdown in China will have a substantial impact on other major markets and economies in the world. Chinese industry is closely related to numerous international supply chains.

Furthermore, while at the turn of the century, China was responsible for approximately 7% of global economic activity, this year (2019), this figure is expected to rise to 19%.

The Chinese economy is so large and so intertwined with many other economies worldwide, that it easily determines the global price for many manufacturing products.

Half of all the world’s steel, copper, coal and cement are exported to China. Accordingly, if China is not purchasing these materials, a huge portion of the demand comes down which in turn likely leads to price drops for these commodities.

How does this Impact the Aluminum Industry?

Contrary to other metals, China’s supply of primary aluminum is almost balanced, i.e. it produces basically as much primary aluminum as it consumes, which is well more than half of the global market’s supply. In the past, China was in a surplus on the production side, but this year, depending on curtailments and government policies, some analysts like the CRU expect it to be in a deficit. This deficit will not be as deep as the rest of the world, but China will not be able to compensate any more for the deficit elsewhere in the world. Despite all curtailments, China has been adding a lot of new capacity, specifically a 6% increase in primary Al production in 2018, which will eventually come online. Utilization rates along the entire value chain of aluminum production, including most semis, are low and we know that China can be very quick to react in the market place to rising prices and increase production. Despite US Section 232 duties on Chinese exports of downstream aluminum, products hit record levels in 2018, growing by nearly 25% YoY according to the Aluminum Association. According to CRU, only 29% of the aluminum demand growth came from within China. The rest was all export driven, whereas in the previous 5 years, almost three quarters of the demand increase was generated domestically.

Despite the global aluminum deficit, the LME price for primary aluminum is low and few analysts expect it to move anywhere but sideways this year. China is certainly going to be a huge factor in any movement. The Chinese ban on scrap imports has had a major impact on scrap and secondary aluminum prices in North America, and most experts expect it will take at least another 2-3 years until the necessary structural changes occur so that more scrap processing will take place in North America, and recycling will play the role it really should in our economy.

How Eccomelt356.2 Provides an Alternative & More Economical Solution

Eccomelt LLC is contributing to high value aluminum recycling, enabling integration of recycling content in high tech and safety critical castings, replacing to a certain extent primary aluminum, and making foundries and die casters more competitive on a global scale.

Eccomelt356.2 | Direct Substitute for A356.2 Ingot, Sow & T-bar

Alongside Alcan R&D, Eccomelt has developed a patented revolutionary process that produces a specification alloy from aluminum wheels at a lower cost than traditional methods and that meets that EPA definition of CLEAN CHARGE.

Eccomelt ships products to foundries within North America including the United States, Canada, and Mexico, and worldwide, such as France, Ireland, Italy, Serbia, and Spain. Our product is the material of choice for many consumers because it is chemically pure and environmentally-friendly. Its shredded form has achieved higher melting rates than Ingot, Sow or T-Bar. Environmental testing has also proven the process eliminates all coatings.

If you are an industry affected by the tariffs and proposed sanctions and looking for alternatives please give us a call. We can be contacted at (888) 356-9557 or visit our website and fill out our contact form. We would be delighted to hear from you.