The CoVID-19 pandemic outbreak was a major roadblock for the automotive sector. In March 2020, 80% of automotive and related companies reported that the health crisis will have a direct impact on their revenues. 78% also stated they did not have enough staff to run a production line. The reason for such predictions is that 80% of the world’s auto supply chain is tied to China, the “epicenter’ of the CoVID-19 virus.

According to the China’s Association of Automobile Manufacturers, its year-on-year sales plunged by 48.4% in March amid the pandemic crisis. Most businesses in mainland China were closed for business as authorities imposed strict social distancing measures. As such, production shortfalls resulting from supply chain disruptions in China had undoubtedly affected global automakers and their sales in the first quarter of the fiscal year.

Fortunately, the downward trend is seemingly coming to a halt and the auto sector is now seeing a rebound. The reason for this is simple. As restrictions are lifted, businesses are starting to reopen and people are heading back to work, and commuters are reluctant to take the public transit. They would rather spend 30 minutes to an hour, if not more, in traffic than to risk their health on the subway or train.

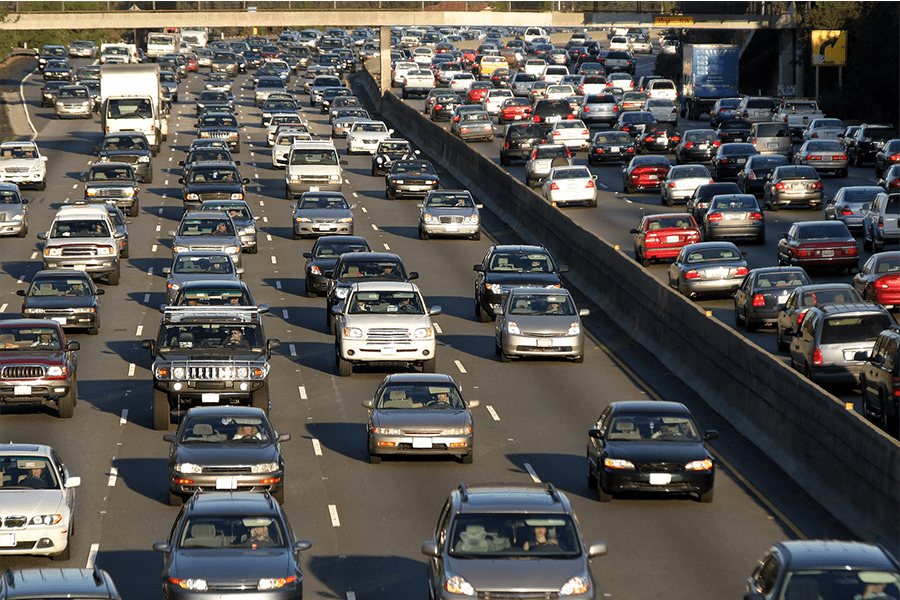

Road Congestion during Morning Rush Hour in Major Cities has Become Increasingly Pronounced

Road congestions are a global phenomenon and are the result of individual virus-control measures as well as increased vehicle volumes. In the short term, analysts are predicting that local governments will accept this trend due to health concerns and consumers will seek independence when traveling for leisure or business purposes.

Individual commuters are not the only ones driving this trend upward with their desire to protect their health. Businesses are also beginning to consider alternatives to public transit, such as company car allowances, private bus services and leasing smaller office spaces in suburban locations closer to where their employees live. Extremely large companies are even considering the possibility of subsidizing their employees’ purchases of private vehicles and funding rental cars.

In Beijing, Shanghai and Guangzhou, China, for example, morning traffic has been higher than the 2019 averages. The subway usage, on the other hand, has decreased, according to the statistics compiled by BloombergNEF. Volume on Beijing’s metro system is 53% below pre-virus levels. Subway usage in Shanghai and Guangzhou has also decreased by 29% and 39%, respectively.

The latest statistics from the China Association of Automobile Manufacturers also show that China’s auto production and sales rebounded in March, with output rising almost 400% from February. Auto sales also jumped 361.1 % month-on-month.

In Berlin, Germany, another city to have already eased some restrictions, public transit use is significantly down. According to stats compiled by Apple Inc., it remains down by 61%. On the other hand, the number of people driving is seeing a recovery and is now just 28% below normal. Experts are predicting an upward trend of the number of drivers on major roads in the near future.

In Ottawa, Canada, experts are also seeing similar trends. According to Apple Maps data, the number of driving directions has recovered to 40% of normal levels. Directions for mass transit, on the other hand, have plateaued at 80% below the norm.

With the expected increase in automotive sales, there will be a resurgence in demand for A356.2 in the manufacturing of aluminum castings for car parts. Eccomelt LLC is fully stocked as it continues to supply the automotive industry eccomelt356.2, our cost effective and sustainable substitute for A356.2. We have both engineering and metallurgical consultants ready to help support new customers wishing to incorporate eccomelt356.2 in their melting process, and we have implemented new protocols to ensure the safety of our employees and customers throughout the course of the pandemic.

Eccomelt356.2 | Direct Substitute for A356.2 Ingot, Sow & T-bar

Alongside Alcan R&D, Eccomelt LLC has developed a patented revolutionary process that produces a specification alloy from aluminum wheels at a lower cost than traditional methods and that meets that EPA definition of CLEAN CHARGE.

Eccomelt LLC ships products to foundries within North America including the United States, Canada, and Mexico, and worldwide, such as France, Ireland, Italy, Serbia, and Spain. Our product is the material of choice for many consumers because it is chemically pure and environmentally-friendly. Its shredded form has achieved higher melting rates than Ingot, Sow or T-Bar. Environmental testing has also proven the process eliminates all coatings.

If you are an industry affected by the tariffs and proposed sanctions and looking for alternatives please give us a call. We can be contacted at (888) 356-9557 or visit our website and fill out our contact form. We would be delighted to hear from you.