The price of aluminum has drastically fallen in the last month due to the outbreak of the new coronavirus that originated in the Chinese city of Wuhan.

Industry experts are fearing a repeat of the 2003 “SARS Shock”, when an epidemic of severe acute respiratory syndrome shook markets around the world.

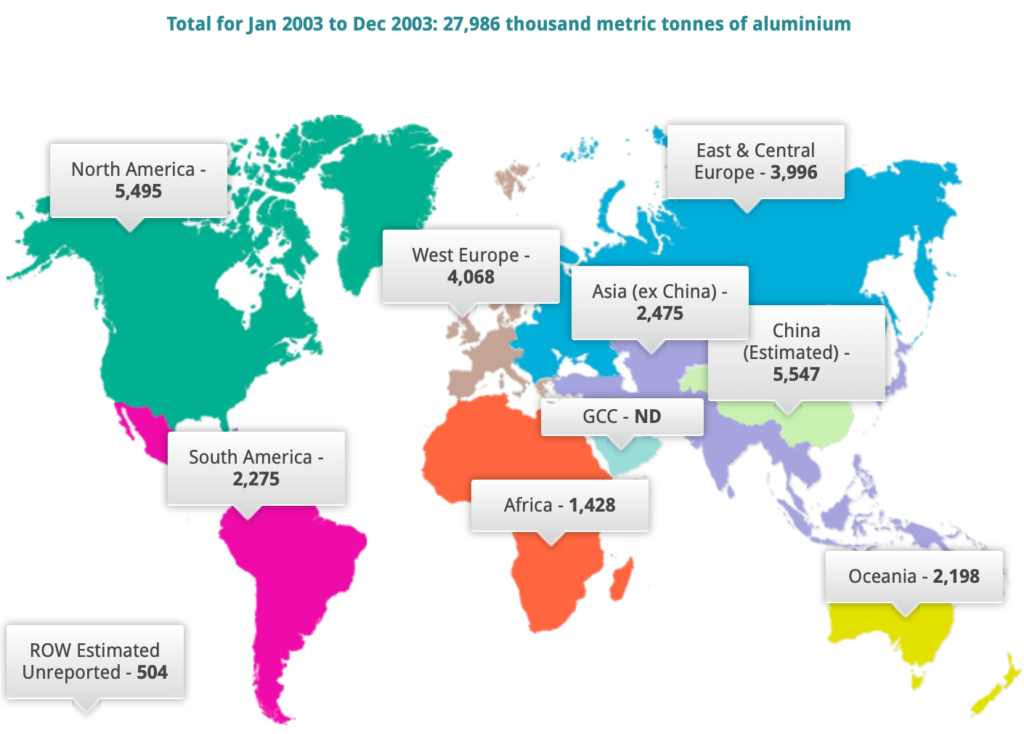

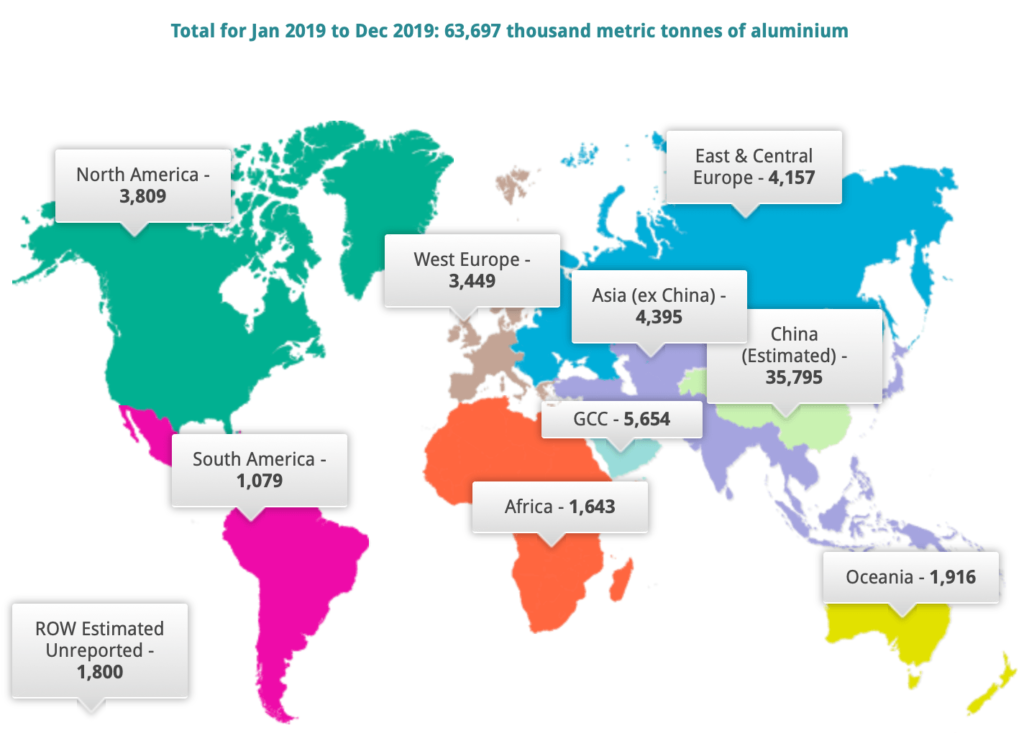

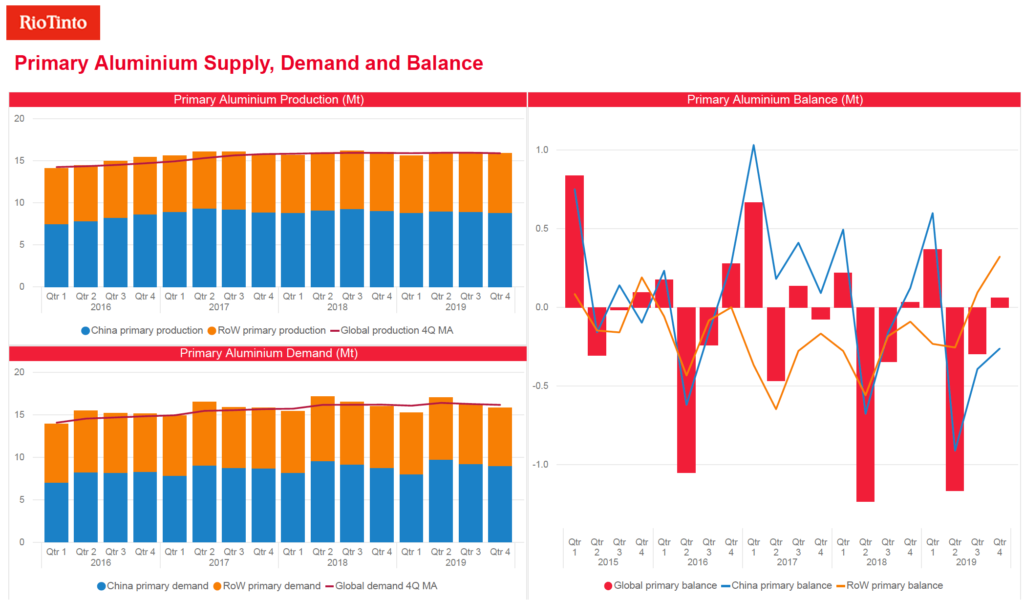

China currently consumes almost half of the world’s metals and mining resources, which is twice the consumption that occurred during the Severe Acute Respiratory Syndrome (SARS) outbreak. Regarding aluminum specifically, the amount is more extreme: In 2003 China produced around 5.5 million tons of primary aluminum versus over 35 million tons in 2019 , which represents far more than half of the global production. On the demand side we have seen the same development. Any sustained disruption as a result of the virus can significantly hinder global metals markets.

nCoV-19 Outbreak’s Impact on Aluminum Demand

For the first time in more than a decade, demand in the global aluminum market fell marginally in 2019 as a result of global trade wars and slowing consumption. According to the World Bureau of Metal Statistics, the aluminum market was in surplus of 685,000 metric tons last year, which was a drastic increase from the surplus of 118,000 tons in 2018. While not all analysts and producers agree with these exact numbers, they would certainly agree with this general trend.

To date, the surplus has been relatively small. However, industry experts are fearing that the surplus will increase exponentially as semi-finished product producers in China are disproportionately hit by travel bans and material supply issues. Experts are also anticipating that the consumption in China will be so severely interrupted in the first quarter that primary inventory will build up rapidly — just like it did during the 2008 global financial crisis.

Fortunately, the Chinese government is lifting movement restrictions across China, except for in the Hubei province (the epicenter of the outbreak). Downstream operations are also largely going back to normal. March will remain a severely depressed month for demand and a challenging month for many producers. However, industry experts are predicting that the demand will begin to bounce back in April.

nCoV-19 Outbreak’s Impact on Aluminum Pricing

Restrictions that are causing curtailments in production could lower aluminum prices in the short term, although this may be offset by macroeconomic worries around Chinese GDP.

With infections still looming and the dark cloud hovering, it is very difficult to quantify the impact the coronavirus on both the Chinese and global economies. In the near term, key uncertainties around economic impact of the virus include the Chinese authorities’ ability to contain the virus, response of consumer and business sentiment, and policy actions such as monetary and fiscal easing.

What we do know is that commodity market prices are mirroring increasing economic risks despite little change in actual fundamentals. Unfortunately, the longer this outbreak continues the bigger the ripple effects will be on global commodity markets, including aluminum.

China is the biggest consumer of aluminum, and also the biggest producer, therefore the restrictions caused by nCoV-19 may cause supply disruptions both inside and outside of China. Eccomelt LLC is positioned to supply the aluminum industry outside of China while we wait and hope that this virus does not harm more people and that a vaccine is available soon.

About Eccomelt | Direct Substitute for A356.2 Ingot, Sow & T-bar

Alongside Alcan R&D, Eccomelt LLC has developed a patented revolutionary process that produces a specification alloy from aluminum wheels at a lower cost than traditional methods and that meets that EPA definition of CLEAN CHARGE.

Eccomelt LLC ships products to foundries within North America including the United States, Canada, and Mexico, and worldwide, such as France, Ireland, Italy, Serbia, and Spain. Our product is the material of choice for many consumers because it is chemically pure and environmentally-friendly. Its shredded form has achieved higher melting rates than Ingot, Sow or T-Bar. Environmental testing has also proven the process eliminates all coatings.

If you are an industry affected by the tariffs and proposed sanctions and looking for alternatives please give us a call. We can be contacted at (888) 356-9557 or visit our website and fill out our contact form. We would be delighted to hear from you.